The Unbearable Complexity of Drug Pricing

"My Ozempic Journey" continues, Elon's bad week, plus "Coyote vs. Acme," how to respond to "I do my own research," and more! (Issue #166)

Before we get to today's main topics, some miscellaneous goodies and things worth your attention…

"The kerning on the Pope's tomb is a travesty" in Fast Company made me guffaw. "Kerning" is how typographers talk about the spaces between letters, and it can become important in surprising ways.

For a true travesty around the loss of Pope Francis, see Trump's AI-generated image of himself in papal regalia. One BuzzFeed commenter described this as "deeply insulting & deranged," but is it out of character? We are talking about the man who had his ex-wife and mother of his three eldest children buried on a golf course.

Coyote vs. Acme is headed to theaters! I loved the Ian Frazier piece in The New Yorker that spawned this movie, and so I was sad when WBD wrote off the completed, in-the-can film for tax reasons. How delightful that Ketchup Entertainment will now release it! Does this mean there's hope for Batgirl, too?

Speaking of old Looney Tunes, Bugs Bunny as a Genie singing "Ickity Ackity Oop" has been my earworm of the week. (Racist in retrospect, but I was five when I saw it.)

"Chuck E. Cheese Launches CEC Media Network" from QSR Magazine: this combines in-store and new streaming channels. "With over 40 million guests annually, each spending 1.5 to 2 hours per visit," the in-the-restaurant advertising environment will combine with new at-home media. When my kids were little, I rarely lasted a whole two hours at Chuck E. Cheese. If the streaming content is that obnoxious, then I have little hope for its long-term viability. However, given the explosion of retail media, it's a savvy thing to test drive.

If you have people in your life who say, "I do my own research," when asked about accepted science like vaccines, then keep this sharp-eyed Washington Post ($) op-ed by Monica Hesse (about some idiotic things that Health Secretary RFK, Jr. has recently said) bookmarked and handy.

It won't do much to convince misinformationophiles about things bordering on fact, but it will at least help you to remind yourself about the existence of scientific thinking. Here's my favorite bit:

It probably goes without saying, but just in case: Researching a vaccine is substantially more complicated than researching a stroller. You research strollers by typing “best strollers” into Wirecutter and buying whichever one has cupholders. You research a vaccine by getting a PhD in immunology or cellular and molecular biology, acquiring a lab in which you can conduct months or years worth of double-blind clinical trials, publishing your findings in a peer-reviewed academic journal, and then patiently navigating the government and industry regulations that are required to make sure your vaccine is safe and effective.

Unless, of course, what Kennedy meant by “do your own research” was “faff around on the internet until you find someone saying something you like,” in which case, sure. You can probably knock that out in an afternoon.

Practical Matters:

Sponsor this newsletter! Let other Dispatch readers know what your business does and why they should work with you. (Reach out here or just hit reply.)

Hire me to speak at your event! Get a sample of what I'm like onstage here.

The idea and opinions that I express here in The Dispatch are solely my own: they do not reflect the views of my employer, my consulting clients, or any of the organizations I advise.

Please follow me on Bluesky, Instagram, LinkedIn, and Threads (but not X) for between-issue insights and updates.

On to Top Story #1...

How Bad was Elon Musk's Week REALLY?

Regular Dispatch readers know that I've been skeptically covering Elon Musk's acquisition of Twitter (and other unhealthy decisions) for years. For both Musk admirers and detractors there has been a lot to follow lately:

Tesla's Q1 results were bad, with net income falling by 71%.

The stock price is down from a high of $429.80 in January to $279.81 when the market closed on Friday, per Yahoo Finance.

Musk responded by saying he would spend more time at Tesla rather than DOGE, which is convenient since he can only work 130 days per year as a non-confirmed "special employee" at the White House, which started 100 days ago.

Tesla's board quietly started looking for a new CEO (WSJ $).

According to The Daily Beast, Musk had a "meltdown" over this, after which Tesla Chair Robyn Denholm posted a strong denial on Twitter/X:

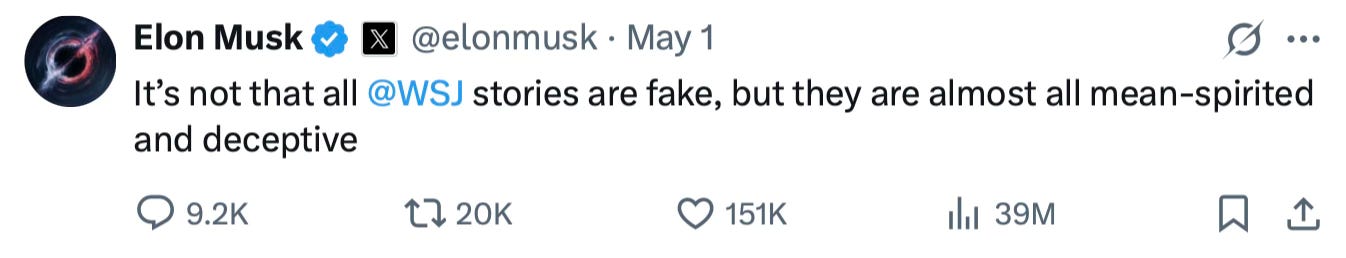

However, it's worth noting that Musk's supposed meltdown consists merely of a few strongly worded tweets, for example:

and…

In Inc. Magazine, op-ed writer Bill Murphy, Jr. pointed out that Tesla having no succession plan is a massive vulnerability for the company.

Musk's hope that robots will infuse new revenue into Tesla seems likely to face intense competition from China ($).

Saturday Night Live, which happily invited Musk to guest host in May of 2021, has seized a comic moment, exercised its reserve activation clause, and brought Mike Myers back to play a hyperkinetic, massively ADD version of Musk over several episodes this season.

"Even Republicans are Falling Out of Love with Tesla" per The Economist ($), which means that if my thesis is right—that Musk's rightward swing was only ever an attempt to sell electric cars to conservatives and that he has no real values beyond money—then the attempt has failed. (Note, too, The Economist's use of the pejorative "Democrat" as an adjective rather than "Democratic," which betrays a political bias.

Analysis

If you look at Tesla's stock over the last 5 months, it resembles the EKG of a man with a bum ticker on a triple espresso plus a short of cocaine.

However, that's falling into a short-term thinking trap (common with public companies). If you look at Tesla's stock over five years (rather than YTD) it's still way up ($54.93 to $279.81).

It made no sense when the company hit an apogee market cap of $1.5 Trillion in December 2024. That was a hallucination that probably had more to do with Musk's influence with the then-incoming Trump 2.0 Administration than anything to do with EVs.

With...

More credible EV competition coming from domestic and foreign auto companies,

An aging set of vehicle designs in general, and

A Cybertruck model that looks like a refugee from the 1980s version of Battlestar Galactica and, more importantly, isn't as functional as other EV Pickups, some of which are leaning into new ad campaigns ($),

Tesla's earnings make sense outside its CEO's political distractions, although Musk's performance as the Artful DOGEr hasn't helped.

In other words, this all adds up to a logical market correction. Tesla dominated the EV field for years. That dominance is waning. QED.

Top Story #2...

The Unbearable Complexity of Drug Pricing: My Ozempic Journey Continues

Regular Dispatch readers know that I've been taking Ozempic for the last few months because I have Type 2 Diabetes and also have struggled to lose weight. I've shared My Ozempic Journey from time to time (this issue is one of those times) and also talked about the Center for the Digital Future's research about Ozempic Disruption generally.

Since I started, my results have been slow but positive: my blood sugar is looking better, and my weight has come down slowly. I don't like to weigh myself, but I can now wear shirts that I couldn't as recently as last summer. The other day, La Profesora said, "that shirt is too big for you to wear," which was both encouraging and dispiriting because now I have to go buy shirts.

My pants are also increasingly baggy. That could be because of the Ozempic, but it also could be due to a Berens Family malady known as GALN or Galloping AssLessNess, which I have inherited from my father. (Thanks, Pop.) In life, some mysteries never find answers.

Last week, a few days after I called in a refill to get a new pen to inject Ozempic, the pharmacist at Rite-Aid (it's the closest pharmacy to my house) called with startling news. "We don't fill prescriptions for Ozempic, Mounjaro or any of the others anymore because we lose money with each sale."

"Really?" I asked, incredulous. "Can you tell me what other pharmacy might still carry Ozempic?"

"Try Costco," the Rite-And pharmacist said in a brief Miracle on 34th Street exercise.

I stopped by Costco after the gym later that day. Costco still carries Ozempic (phew!), so I transferred the prescription and then picked it up the next day. No biggie.

Pharma Alphabet Soup

I didn't understand how it's possible that Rite-Aid could lose money selling Ozempic. As with any prescription, the receipt from the pharmacy has information (I can't call it an explanation for reasons that will soon become less murky although not clear) that lists two prices:

The Usual & Customary (U&C) price

The price that a person with health insurance pays—meaning, the "co-pay."

This is where things get confusing.

I had always thought that U&C was what the pharmacy charged an insurance company, what the insurance company would then pay, less the co-pay.

Oh boy was I wrong.

U&C means the rack rate: what a person with a prescription but with no insurance would pay if she or he walked up to a pharmacy counter and said, "I want to buy this, please."

The U&C for the kind of Ozempic that I take is $1,305.99.

As near as I can tell, U&C is a fantasy number: no sane person would ever pay it; no pharmacy is likely to get away with charging it unless the customer is paying no attention.

U&C is different from WAC, the "Wholesale Acquisition Cost," that pharmacies and the uninsured pay to Novo Nordisk, the pharmaceutical company that makes Ozempic. The WAC for Ozempic, per the Novo Nordisk website, is $997.58.

WAC is a more practical number, close to what an uninsured person would pay if they walked up to a pharmacy counter with no insurance, no coupons, no rebates, etc.

Then there's NADAC, the "National Average Drug Acquisition Cost," that Medicaid tracks monthly. To get this information, I had to go to the Medicaid site, download the gigantic April 2025 spreadsheet, and then open it in XL to find the Ozempic information alongside thousands of other drugs:

This, too, is difficult to interpret without doing some arithmetic because the price listed is per milliliter with three milliliters per pen, so the NADAC price for the kind of Ozempic I take is $311.86 x 3 = $935.58.

When I searched my prescription on GoodRx (a comparison site for meds), it checked 13 pharmacies in my area with retail/no-insurance prices per pen ranging between $964.99 (Costco) and $1,197 (Capsule Pharmacy, of which I'd never heard until that click).

All this, by the way, is the simple version. You can get a sense of how complex drug pricing gets by taking a quick look (don't linger; you'll get a headache) at this chart from US Pharmacist, a trade journal:

None of this explains why Rite-Aid loses money on Ozempic

As I dug deeper, I learned that pharmacies buy meds from drug companies at or around WAC.

When a customer has insurance, the pharmacy charges the insurance company, but how much the insurance company pays out to the pharmacy depends on the rate that a Pharmacy Benefits Manager (PBM) has negotiated. The payout can be less than the cost of the drug, depending on the PBM contract, and the pharmacy cannot increase the cost of the co-pay to make up the difference.

The reason Rite-Aid in particular has stopped filling Ozempic prescriptions probably has to do with the pharmacy having to sell off Elixir, its own PBM, as part of its deal to emerge from bankruptcy, which concluded just a few months ago. Without Elixir, Rite-Aid has less leverage, so the pharmacy's recourse is to stop selling unprofitable products even though in doing so it alienates its customers.

As recently reported by WSJ ($), big pharma manufacturers have successfully spent a lot of money throwing the blame for high drug prices on PBMs. Doing this obfuscates the greed of the pharma companies themselves as they set WAC at eye-poppingly high prices. (Their usual explanation/excuse for these prices is that for every successful drug they bring to market they lose billions in R&D for other drugs that fail.)

PBMs are profitable businesses because they are secretive. The old business saw that there's margin in mystery applies to PBMs because they don't disclose rebates, discounts, and other negotiations. This is why increasing PBM transparency is a bipartisan issue, which also means that Big Pharma has been energetically lobbying both sides of the aisle.

The short version? The numbers on your pharmacy receipt (U&C and your co-pay) look like they are conveying information, but those numbers are an exercise in obfuscation. "Look at how much money you saved!" the receipt implies. In reality, pharmacy customers have no idea how much their pharmacy spent to buy the drugs, how much money the insurance pays the pharmacy that dispenses the drugs, and what the PBM middlemen get out the process.

Action or Theater?

On April 15, President Trump issued an executive order (with no force of law) about reducing drug prices for Americans. This included language directing the Department of Health and Human Services (HHS) to take action around "Improving disclosure of fees that pharmaceutical benefit managers (PBMs) pay to brokers for steering employers to utilize their services."

However, just 12 days earlier on April 3, the administration ordered HHS to reduce spending by 35% on top of cutting 20,000 HHS jobs just days before on March 27.

How, I wonder, will a much-reduced HHS (run by a man skeptical of modern medicine) find the resources to act on reducing drug prices for ordinary Americans?

Thanks for reading. See you next Sunday.

* Image Prompt: "A comic book style picture of a middle-aged white man with salt-and pepper hair, wearing glasses. He walks along a woodland path with a stick over his shoulder. At the end of the stick is a cloth that contains his belongings."